Information for British constituents with an interest in establishing participatory democracy and freedom from corrupt representation, factional impositions and unjust settlements

Introduction to the role of ethics in the democratic process Introduction to the role of ethics in the democratic process

This section is in preparation...

Quite often our politicians will refer to the benefits of, ".. Democracy, freedom and the rule of law". Whereas there is a need for a level of trust in the behaviour of constituents to abide by laws which as a community they have professed to be just, it is important to ensure the laws themselves do not encourage unethical behaviour. Under such circumstances, such a "rule of law" would be unjust and would suppress freedom.

Ethical decisions

Reality

Ronald Howard coined the term "decision analysis" in the 1960s, as a discipline for which he is the leading exponent. Besides this quantitative decision analysis approach, Howard made important contributions to the analysis of the ethics involved in decision making. This integration of quantiative analysis with the ethical foundations and the implications of decisions is particularly relevant to the development of better decisions in a participatory democratic environment to substitute the levels of compromise associated with decisions by political party politicians. |

|

|

Ethics is based on well-founded standards of right and wrong that prescribe what humans ought to do, usually in terms of rights, obligations, benefits to society, fairness, or specific virtues. The role of politicians, as legislators in encouraging ethical decisions is to ensure that the law is fair in the sense of balancing acceptable conduct with the sanctions imposed when individuals or companies transgress the law. Sanctions should be high enough to deter transgression of the law.

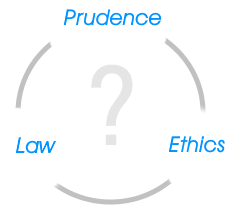

When a corporate manager is faced with a decision, the main considerations that are taken into account are the law (what is required), prudence (what is the most beneficial decision) and ethics (what is generally expected). So, looking at the possible range of decision options  from the standpoint of the company, prudence will orientate the decision towards the highest cost-benefit in commercial terms. If the sanctions are high, the costs can become too high so as to encourage decisions that err on the side of the law and ethical expectations. On the other hand, if the sanctions are very weak, the manager will maximize the cost-benefit of the decision by taking an unethical decision which transgresses the law because the sanctions as consequential associated costs are so low that the benefits outweigh them significantly. In such circumstances, the sanctions applied simply become a cost of doing business. from the standpoint of the company, prudence will orientate the decision towards the highest cost-benefit in commercial terms. If the sanctions are high, the costs can become too high so as to encourage decisions that err on the side of the law and ethical expectations. On the other hand, if the sanctions are very weak, the manager will maximize the cost-benefit of the decision by taking an unethical decision which transgresses the law because the sanctions as consequential associated costs are so low that the benefits outweigh them significantly. In such circumstances, the sanctions applied simply become a cost of doing business.

Unethical enrichment of financial services arises directly from corrupt political decisions

Politicians, as in the example of the corporate management decision, will aim to take the most prudent decision in the interest of their party. The prudent decision is to enact legislation that assists party benefactors so as to ensure sustained financial support for the party. Therefore, a relaxation of regulations and reductions in the weight of sanctions applied to financial services is the resulting decision. However, this is unethical and unfair encouraging companies, in the financial services sector, to take advantage of the law by acting unethically. Thus, unethical political decisions encourage unethical corporate behaviour at an unacceptably high cost to the majority. It is more than apparent that such decision making does not comply with the Nolan Principles of Public Life and cause widespread prejudice to the constituents whose interests party politicians are suppose to represent. |

|

|

Over the period 1975 through to date, the sanctions associated with financial regulations have become extremely "light" and as a result fraudulent and unethical decisions and behaviour ran rampant in the financial services sector resulting in the 2008 financial crisis. The reward to the sector, many of whom should have been allowed to fail, was quantitative easing which enabled the same corporations to secure funds at close to zero interest rates and to continue acting in a way that shuns social and national responsibility.

Although the "guilty parties" include a long list of corporations, banks and hedge funds, their behaviour was primarily encouraged by decisions taken by political party politicians in government, passing legislation to make all of this possible and without any regard for the standards of ethics in the sector. By the same score, given that those who behave in this unethical way are in general those with enough funds to contribute to political parties, they also have the corporate media in their corner to keep political parties in line.

The result is a state of affairs where constituents carrying out small scale fraud will end up in prison, financial sector executives under whose watch their corporation has been guilty of evidence-based multi-£ billion fraud prejudicing thousands of people do not face any repercussions and the nominal fines are paid by the corporation. The result of the compromised position of political parties is the design and passing into law, irresponsible legislation which is a direct incentive to a widespread continuation of unethical behaviour in the sector that prejudices the majority of the constituents of the country.

As a result we have legislative provisions which are unfair and unethical fashioned by political parties who are controlled by the small factions who benefit from this type of "rule of law".

It is time for a politics without parties!! |

|